Identity theft in the UK rises by a third

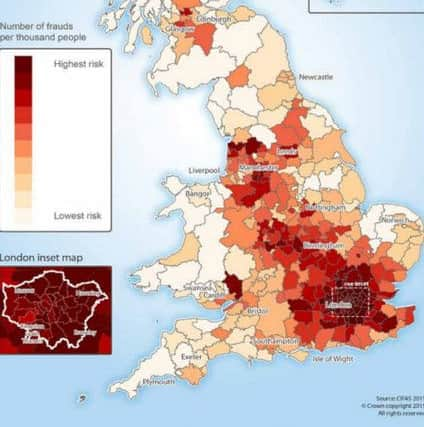

Data from fraud prevention service Cifas shows 34,151 confirmed instances of identity fraud were recorded in the first quarter of 2015.

Identity fraud is when criminals abuse personal data to impersonate a victim or to create fictitious identities to obtain products and services.

Advertisement

Hide AdAdvertisement

Hide AdAccording to the figures for the three-month period, credit cards were involved in 14,103 confirmed cases, while bank accounts were involved in 9,349 cases.

Cifas said 80% of identity fraud in the first quarter was attempted online.

Simon Dukes, Cifas chief executive, said: “Fraud figures fluctuate over time, as fraudsters adapt and try new ways of achieving their aims.

“What these figures show is that identity fraud continues to be the most serious fraud threat and that the first quarter of the year has been a very profitable one for organised identity criminals.

Advertisement

Hide AdAdvertisement

Hide Ad“Our data is just the tip of the iceberg - more needs to be done to identify the true scale of fraud in the UK and educate individuals about the dangers and the steps that can be taken to protect themselves.”

Detective Chief Superintendent Dave Clark, from City of London Police, said: “Identity fraud is at the heart of much of today’s criminality, acting as a key facilitator for a host of other types of offences.

“To stop this from happening we must all take responsibility for protecting our personal information, especially when working and playing online.

“By following some simple procedures, such as creating strong passwords, protecting internet connected devices with up-to-date security software and not sharing too much personal information online, we can make life much more difficult for the identity fraudsters and ensure fewer of us fall victim to what is a highly disruptive and upsetting crime.”

Advice for online safety

Advertisement

Hide AdAdvertisement

Hide AdExclude important personal information from your social media accounts.

Check your social media account privacy settings, including on all your mobile devices.

Protect your online passwords and make them strong.

Watch out for ‘phishing’ emails - if it sounds too good to be true, it most likely is.

Keep your communications networks secure, e.g. Wi-Fi.

Check for the https:// when visiting websites - the ‘s’ stands for secure.

Keep a close eye on your bank statements.

Fraud victim profiles

Advertisement

Hide AdAdvertisement

Hide AdAcording to Cifas, the average age for male and female identity fraud victims is 46.

Those in the 21-30 age range continue to be increasingly targeted - 3,970 people in this range were targeted by identity criminals, a 26% increase from last year.

The findings are in line with Cifas’s fraudscape report published earlier this year. The latest data shows that these trends have been maintained so far this year and that identity fraud remains the biggest fraud threat among Cifas members.

If your identity has been stolen, you should contact your bank, credit card company and local police on the non-emergency phone number 101 as soon as possible and let them know the situation.

You can also report the fraud using the police online fraud reporting service Action Fraud.